Contents

Welcome letter

A note from our CEO on our Possible mission, what we heard from customers this year, and how shared progress shaped our impact in 2025.

Progress in numbers

Key data showing how customers saved money, gained flexibility, and improved financial health—plus, how much they saved on penalty fees we don't charge.

Money Magic

Stories from our Orlando community and our partnership with the Magic, combining customer voices with measurable moments of connection and participation.

Relief on demand

In life's toughest moments, financial relief is Possible. Here's the breakdown of Relief Plan usage, financial hardship trends, and data on how our customers bounced back.

Expanding what’s Possible

A look at new state launches, product expansion, app growth, and how Possible reached more people in 2025.

Since the early days, our focus hasn’t changed. The voices in our community continue to remind us that nobody gets through financial strain alone. The right tools and support, offered at the right time, can change everything. In 2025, that idea showed up in almost every part of our work, and it’s the heart of this year’s impact.

This past year, we brought the Possible Loan to more states. We expanded our Relief Plan. We introduced the Possible Advance so people could access cash when they needed it. Hundreds of folks from our community participated in “Extra Credit”, our award-winning financial literacy series with expert advice from our Chief Credit Officer, Ellen Falbo. Plus: we became official partners of the Orlando Magic, doubling down on our commitment to expand our reach and make financial health possible for everyone.

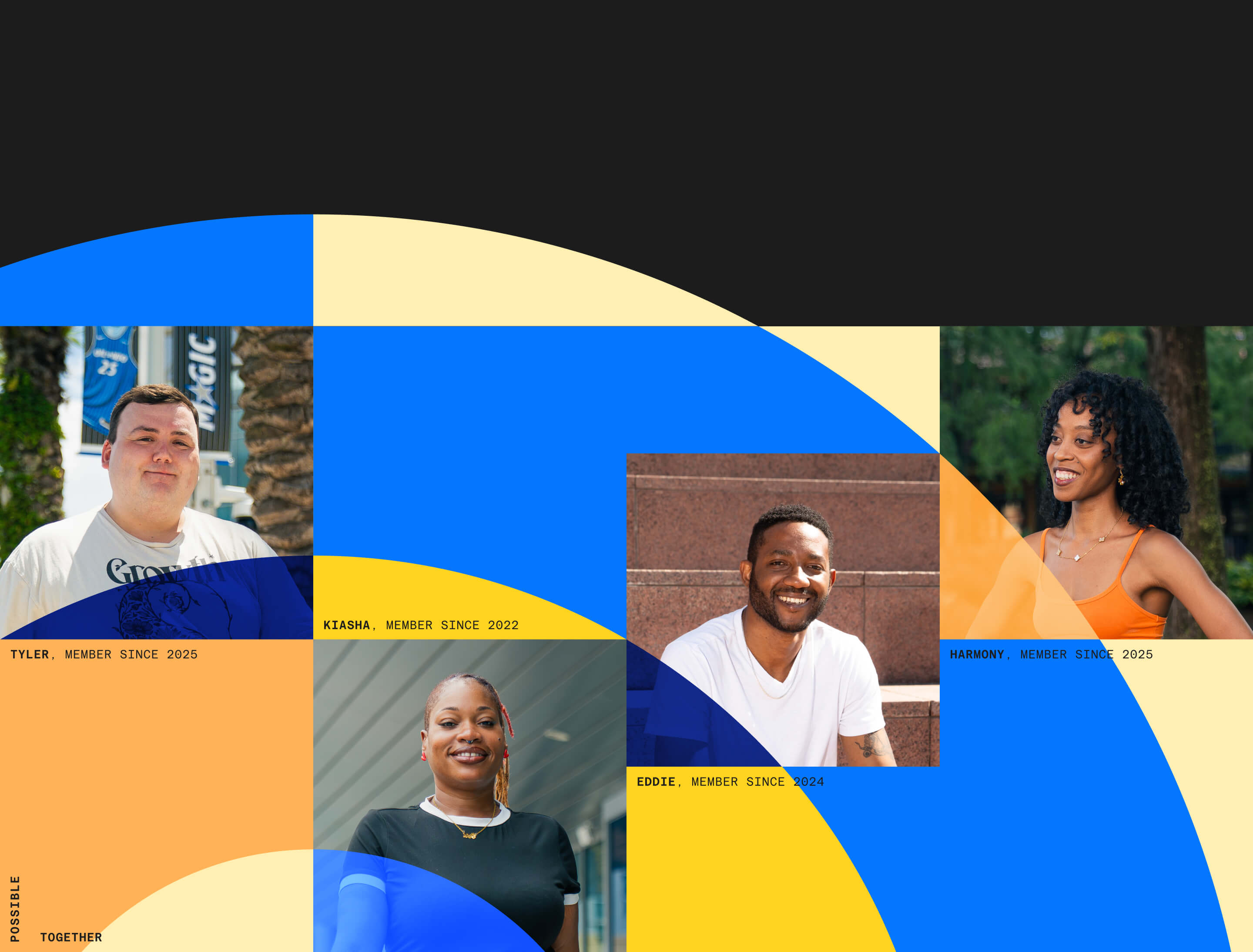

In Orlando, we caught up with our community of customers (and Magic fans!). We met Kiasha, and heard her story about what happened when rising housing costs displaced her family despite working full-time at a bank. She explained why it’s so hard to catch back up after a financial setback—and how flexibility can change everything when it comes to long term financial stability:

“Living paycheck to paycheck, you can be one missed check or one circumstance away from being displaced. I never thought I would be in that situation. I was working at a bank at the time. It was almost impossible to get out of that hole because there was constantly so much money going out, it was impossible to save. So, I'm grateful for programs like Possible. I haven't had any other financial app be as flexible as Possible. That flexibility actually puts the control back in my hands.”

“I haven't had any other financial app be as flexible as Possible. That flexibility actually puts the control back in my hands.”

Kiasha, Medical Triage

Member Since 2022

Kiasha is a real Possible customer. She was compensated for taking the time to share her story. Individual results may vary.

Stories like Kiasha’s are what gives me confidence in where we’re heading. Not just the products and the numbers, but the people. We’ve structured our business so that when Kiasha succeeds, we succeed.

To our colleagues and customers, thank you for being part of Kiasha’s success story—and so many others.

Tony Huang

Co-Founder & CEO, Possible

In 2025, you saved over

million

by choosing Possible, because we never charge insufficient funds fees, renewal fees, late fees, penalty fees or failed payment fees.

That’s over $650 million in savings since our inception.

The impact of a Possible Loan on your finances

Over

Possible Loans were funded in 2025

In 2025, members took

weeks

on average to pay off their Possible Loan.

Fact: the typical payday loan is paid off in full on your next payday, about 2 to 4 weeks away. We’re proud to offer a lot more time.

Source: CFPB

million

payments were moved in 2025—with no rescheduling fees, ever.

We offer payment flexibility up to 29 days out from your original payment date—and there’s no rescheduling fee.

Driana is a real Possible member who was compensated for taking the time to share their experience with us. Individual experiences are unique and may vary.

Better with every loan

On average,

members with no failed payments who returned to Possible for additional loans in 2025 saw their loan offers increase by

of repeat customers with no failed payments received equal or higher loan amounts than before in 2025

Possible payments count toward building credit history

Our members made

payments

In 2025, and each one helped them build credit history—because unlike other lenders, we do report to credit bureaus.

Source: Debt.org

Money in minutes, to spend on whatever you need

The median amount of time it took for Possible members to receive their funds was within just

of accepting their loan offer.

How first-time Possible customers used their Loans in 2025

%

Bills

%

Other or no response

%

Medical expenses

%

Consolidate debt

%

Financing a purchase

%

Purchase vehicle

We caught up with local Possible members (and Magic superfans!) in Downtown Orlando. Everyone featured is an actual Possible customer—they were compensated in return for taking the time out of their busy lives with us to share their honest opinion.

Individual results may vary.

Get to know our Orlando customers

VIP ticket sweeps

tickets we gave to our members in 2025

(plus everyone got $350 in gifts to enjoy the game)

Powering possibilities, on and off the court

Just like the Magic show up for fans every game, Possible is here to fuel your financial wins. Your financial health is our mission.

Here’s the breakdown on why folks enrolled in 2025

%

Medical Care

%

Death in Family

%

Natural Disaster

%

Home Emergency

%

Serious Illness

Medical expenses are a key driver of financial instability for our community.

With 63.9% of all Relief Plan activations tied to medical needs, the data makes one thing clear: health-related expenses can be one of the biggest disruptor of household budgets.

This reinforces what we hear directly from customers—copays, sudden ER visits, specialist bills, and gaps in insurance coverage often arrive without warning. Our Relief Plan was built to meaningfully reduce financial burdens in these moments, allowing members to prioritize their health without falling behind on their loan payments.

Those who enroll in the Relief Plan for medical care reasons may have a harder time bouncing back.

Those who enrolled in the Relief Plan because of a Natural Disaster are 60% more likely to be successful in making their payments, according to a November 2025 analysis.

Looking ahead, the future of medical costs may be even more dire than in 2025: according to Mercer, 2026 is projected to be even more expensive.

We’re still here for you and will continue offer this benefit—no matter how difficult medical expenses can be.

The Relief Plan supports financial recovery.

A majority of customers who utilize the Relief Plan come back to Possible for another loan—and according to our November 2025 analysis, 97% of those subsequent loans don’t charge off. That means for our community, getting back on your feet is Possible even after financial adversity. When you need more time, you can count on Possible.

Late payments are a money grab for predatory lenders. We do things differently.

Late fees are a billion dollar industry. (Source: CFPB) As a Public Benefit Corporation, we structured our business so that when you succeed, we do too. That means offering benefits like the Relief Plan. In the long term, it’s better for everyone.

You ask, we listen

A journey fueled by results

Our members love Possible—and we’re always striving to be even better. Ratings as of December 2025.

customers installed the Possible app

On TrustPilot, we’re proud to have earned an Excellent rating and

On the App Store, 126,327 of you have rated Possible at

Ratings as of December 2025

And on the Better Business Bureau, we earned an

A+

Our Net Promoter score, a measure of customers who would recommend the Possible Loan

Extra credit

Award-winning financial literacy series

Hundreds of you shared what’s on your mind—and our CCO, Ellen, delivered expert answers. Advice dropped all month in April for #FinancialLiteracyMonth, and took home an Anthem Award.

video questions from our community.

Anthem Award

Just for moms

A Mother’s Day $5,000 giveaway

We surprised 25 moms with $200 to treat themselves. Meet some of the winners:

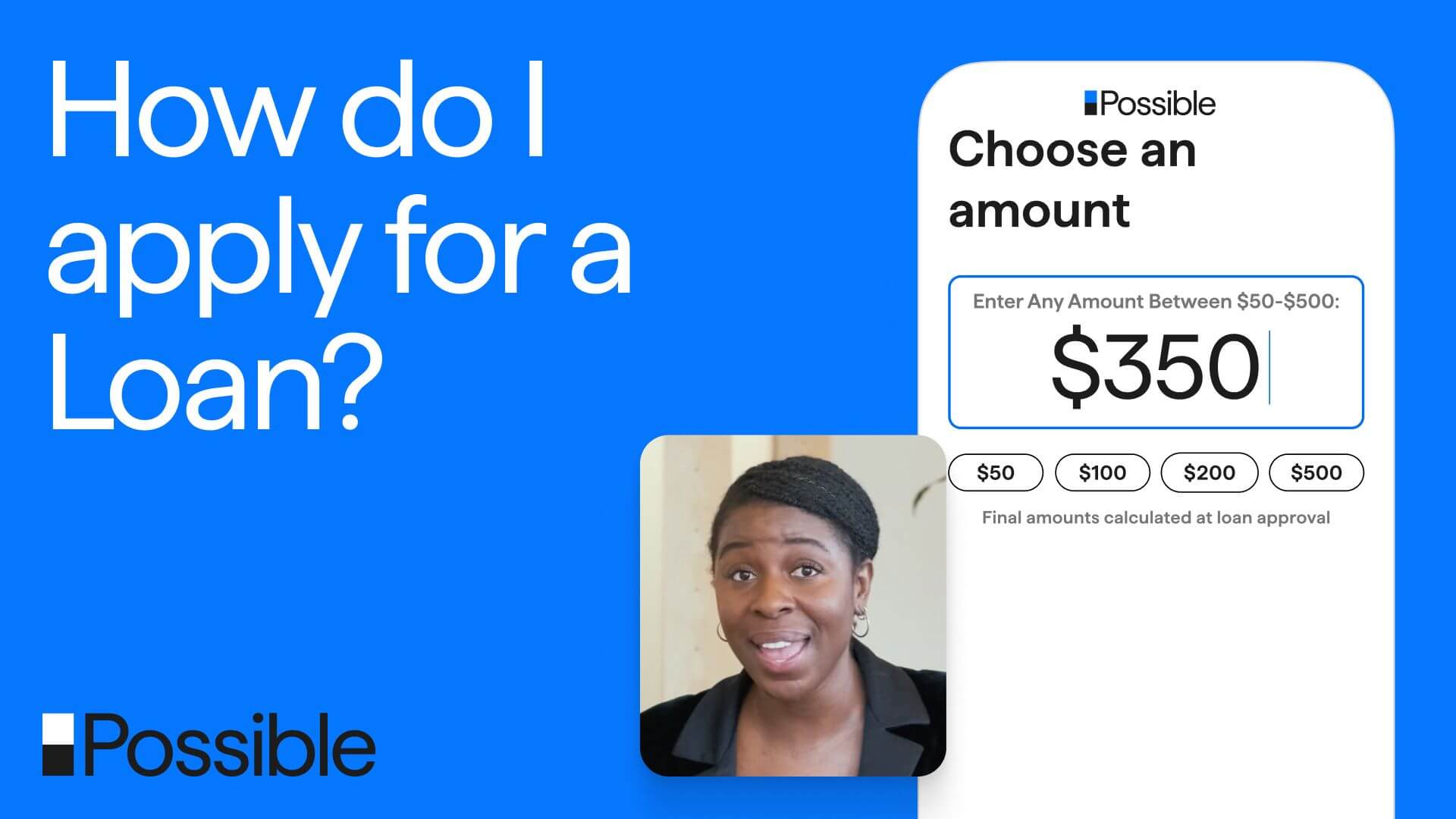

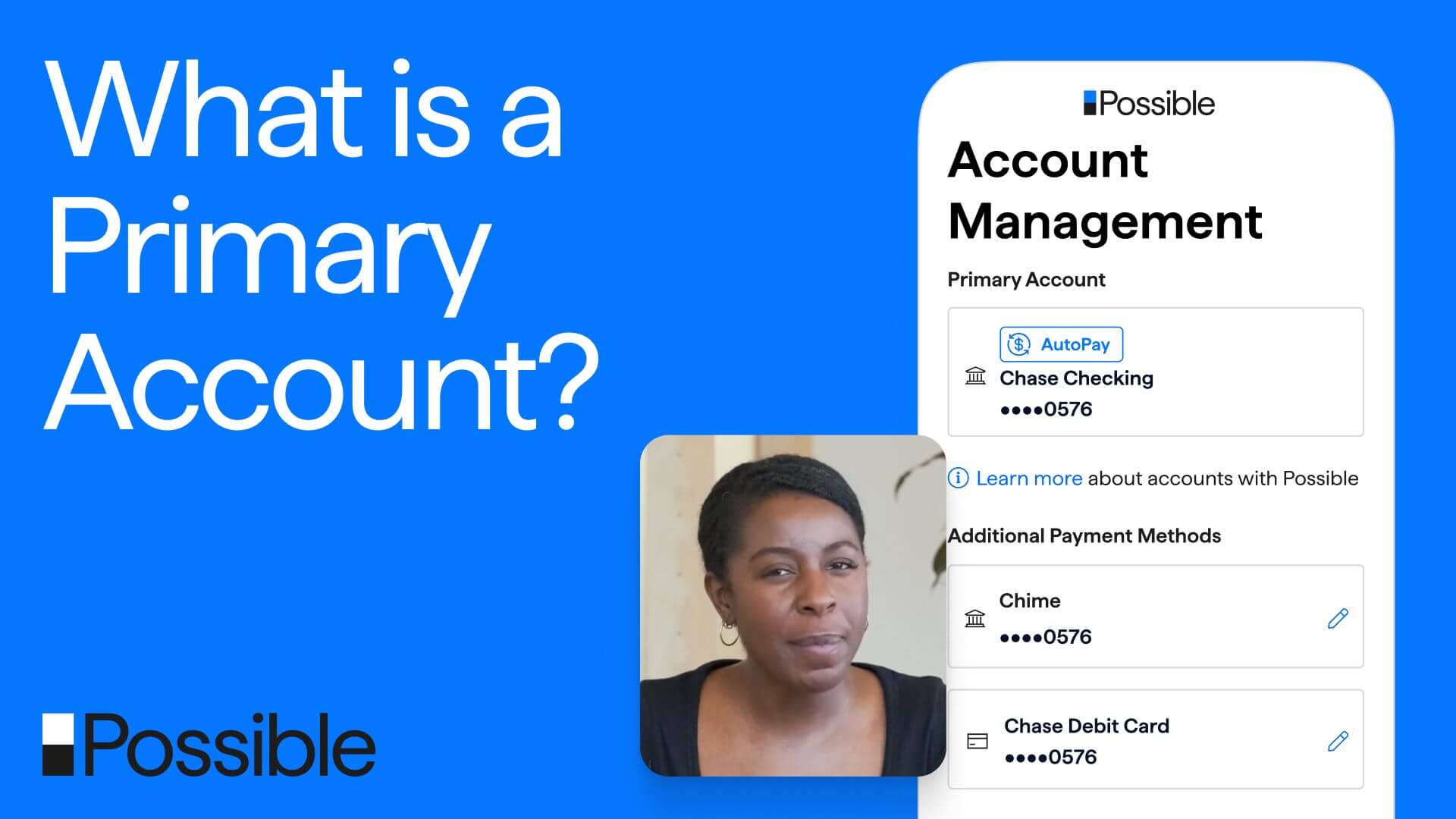

Possible FAQ

25 new episodes: your questions, answered

Our host Uzunma walks through everything from applying to making payments—taking the guesswork out of every step of the process.

No guesswork here

How to actually get approved for a loan (or get more money)

We don’t gatekeep. Our experts shared how approvals work at Possible—so you can make the most of every application.

We've made progress since day one.

Money milestones

We’ve funded over

in loans since our inception

Making Possible history

We’re proud to have served over

customers since founding Possible

Pursuing our mission