Money in minutes

Money in minutes

Prequalify Alerts

Smarter loan offers, right on time with Prequalify Alerts

Get notified when it’s the best time to apply, so you have the best chance of approval

Stay ahead with real-time eligibility alerts

We’ll monitor key changes in your linked bank account and notify you when your eligibility improves. There’s no additional cost to get Prequalify Alerts—just sign up and we’ll let you know when it’s the best time to apply.

Know when to apply

No more guessing. We’ll alert you when your chances are best—just keep your main bank account linked to Possible.

Plus, get payment flexibility

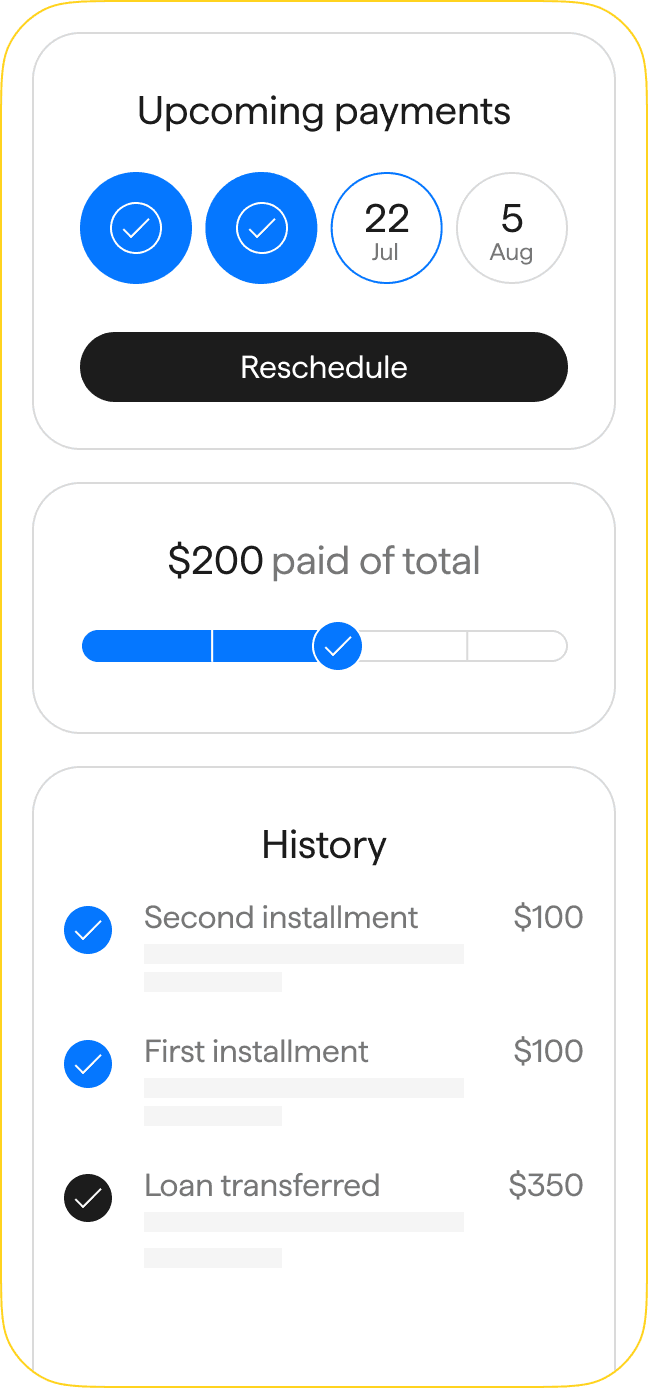

Move any of your payments out up to 29 days from your original due dates. There’s no rescheduling fee, and there’s no impact to your credit report.

Get funds fast*

Get funds fast*

Get funds fast*

Send your money straight to your bank account on approval.

No need to pay in full

Pay back your Possible Loan in 4 parts over your next 4 paydays.¨

Pay back your Possible Loan in 4 parts over your next 4 paydays.¨

How Prequalify Alerts work

Prequalify Alerts work

How Prequalify Alerts work

Prequalify Alerts work

How Prequalify Alerts work

Prequalify Alerts work

01

Keep your bank account linked

When you start your first Possible application, you’ll securely connect your main bank account so we can assess your financial health in real-time. To get Prequalify Alerts, all you need to do is keep it connected.

02

We monitor key changes

Our technology continuously evaluates factors like income deposits, spending patterns and account stability.

On your first Possible Loan?

There’s no risk to apply right now

No FICO check

Your cash flow, paychecks and spending habits help you get approved.

Get the most money Possible

Even if you can’t be approved for the entire amount you request, we’ll still send you a counter-offer if you qualify for a smaller loan

Got denied? You can try again

Keep your bank account linked and we’ll still let you know when it’s the best time to apply

Testimonials from real members

Carrie

Member Since 2021

Carrie

Member Since 2021

Carrie

Member Since 2021

Troy

Member Since 2023

Troy

Member Since 2023

Troy

Member Since 2023

Actual members, compensated for sharing their opinion. Results vary.

Your loan, your call

Get ahead while you pay it back

Take your time with installments

8 weeks. 4 installments. 4 paychecks.¨ Zero worries.

8 weeks. 4 installments. 4 paychecks.¨ Zero worries.

8 weeks. 4 installments. 4 paychecks.¨ Zero worries.

No reschedule fee payment options

Every Possible Loan comes with the flexibility to shift payments up to 29 days out from your original dates.

Enjoy peace of mind knowing we offer financial relief plans

If the worst happens while you have a Possible Loan, we’ve got your back.

Get funds instantly* on approval

Get funds instantly* on approval

Never pay late fees

Build credit history

Frequently asked questions

How can I get real-time Eligibility Alerts?

When’s the best time to apply for a Possible Loan?

Will checking my eligibility impact my credit?

What factors affect my loan prequalification?

I got denied for a Possible Loan. Was it just not the right time to apply?

Frequently asked questions

How can I get real-time Eligibility Alerts?

When’s the best time to apply for a Possible Loan?

Will checking my eligibility impact my credit?

What factors affect my loan prequalification?

I got denied for a Possible Loan. Was it just not the right time to apply?

Frequently asked questions

How can I get real-time Eligibility Alerts?

When’s the best time to apply for a Possible Loan?

Will checking my eligibility impact my credit?

What factors affect my loan prequalification?

I got denied for a Possible Loan. Was it just not the right time to apply?

More articles to read

More articles to read

More articles to read

All products are subject to eligibility and approval by Possible Financial Inc. dba “Possible Finance” and “Possible” or its banking partner Coastal Community Bank. Eligibility for a product is not guaranteed.

For Loans, Possible Finance has direct lending licenses in CA, HI, ID, NV, UT and WA. Idaho Residents: License #RRL-10073; Louisiana Residents: License #1697898; Nevada License #CDTH11200; Ohio Residents: License #ST.760161.000; Washington License #530-CC/SL-111888. California Residents: Possible Finance is licensed by the Department of Financial Protection and Innovation, pursuant to the California Deferred Deposit Transaction Law, License #10DBO-105848.

Loans in AL, AR, AZ, DE, FL, IA, IN, KS, KY, LA, MI, MO, MS, MT, NC, NE, NH, OH, OK, OR, RI, SC, TN, TX, VA, VT, and WY are made by Coastal Community Bank, and serviced by Possible Finance. Texas Residents: Possible Finance is a licensed Credit Access Business; License #1800061850-160823.

*Funding usually within minutes but may take up to 5 days.

^Loan amounts & structure vary by state.

°Possible uses fee and payday loan usage information from the Consumer Financial Protection Bureau, Center for Responsible Lending, Pew Charitable Trusts, and the Consumer Federation of America to arrive at our Fees Saved Calculation. Savings based on the maximum fees Possible could have charged customers over the typical payday loan term, including late fees, insufficient funds fees, etc. Results will vary.

¨See possiblefinance.com/samplepaymentschedules for rates & terms examples.

ˇReal customer compensated. Results may vary.

˘Possible Loans offer up to 29 days of payment flexibility from original due date.

Possible Card is issued by Coastal Community Bank and serviced by Possible Finance, pursuant to its license with Mastercard International Incorporated. Arizona Residents: Licenses #CA-1033558, #CA-1041621, and #CA-1041622; California Residents: License #10595-99; Hawaii Residents: License #COLAX-1238-0; Illinois Residents: License #17.022449; Louisiana Residents: Registration #446766611; Maine Residents: License #SLM15758; Maryland Residents: License #1697898; Massachusetts Residents: Registration #LS1697898; Nebraska Residents: License #1697898; New Jersey: Registration #19095; North Dakota Residents: License #MB104104; Oregon Residents: License #1697898; Pennsylvania Residents: Registration #95262; South Dakota Residents: License #1697898.MYL; Vermont Residents: License #LSO-1697898; Washington Residents: License #6041888588-001-0001: West Virginia Residents: Registration #2417-3349.

All trademarks and brand names are property of their respective owners. Use of them does not imply any affiliation with or endorsement by them.

If you have questions or concerns, please contact the Support Team at support.possiblefinance.com

Mailing Address: Possible Finance, PO Box 98686, Las Vegas, NV 89193

Possible Financial Inc. © 2025 - NMLS #1697898

All products are subject to eligibility and approval by Possible Financial Inc. dba “Possible Finance” and “Possible” or its banking partner Coastal Community Bank. Eligibility for a product is not guaranteed.

For Loans, Possible Finance has direct lending licenses in CA, HI, ID, NV, UT and WA. Idaho Residents: License #RRL-10073; Louisiana Residents: License #1697898; Nevada License #CDTH11200; Ohio Residents: License #ST.760161.000; Washington License #530-CC/SL-111888. California Residents: Possible Finance is licensed by the Department of Financial Protection and Innovation, pursuant to the California Deferred Deposit Transaction Law, License #10DBO-105848.

Loans in AL, AR, AZ, DE, FL, IA, IN, KS, KY, LA, MI, MO, MS, MT, NC, NE, NH, OH, OK, OR, RI, SC, TN, TX, VA, VT, and WY are made by Coastal Community Bank, and serviced by Possible Finance. Texas Residents: Possible Finance is a licensed Credit Access Business; License #1800061850-160823.

*Funding usually within minutes but may take up to 5 days.

^Loan amounts & structure vary by state.

°Possible uses fee and payday loan usage information from the Consumer Financial Protection Bureau, Center for Responsible Lending, Pew Charitable Trusts, and the Consumer Federation of America to arrive at our Fees Saved Calculation. Savings based on the maximum fees Possible could have charged customers over the typical payday loan term, including late fees, insufficient funds fees, etc. Results will vary.

¨See possiblefinance.com/samplepaymentschedules for rates & terms examples.

ˇReal customer compensated. Results may vary.

˘Possible Loans offer up to 29 days of payment flexibility from original due date.

Possible Card is issued by Coastal Community Bank and serviced by Possible Finance, pursuant to its license with Mastercard International Incorporated. Arizona Residents: Licenses #CA-1033558, #CA-1041621, and #CA-1041622; California Residents: License #10595-99; Hawaii Residents: License #COLAX-1238-0; Illinois Residents: License #17.022449; Louisiana Residents: Registration #446766611; Maine Residents: License #SLM15758; Maryland Residents: License #1697898; Massachusetts Residents: Registration #LS1697898; Nebraska Residents: License #1697898; New Jersey: Registration #19095; North Dakota Residents: License #MB104104; Oregon Residents: License #1697898; Pennsylvania Residents: Registration #95262; South Dakota Residents: License #1697898.MYL; Vermont Residents: License #LSO-1697898; Washington Residents: License #6041888588-001-0001: West Virginia Residents: Registration #2417-3349.

All trademarks and brand names are property of their respective owners. Use of them does not imply any affiliation with or endorsement by them.

If you have questions or concerns, please contact the Support Team at support.possiblefinance.com

Mailing Address: Possible Finance, PO Box 98686, Las Vegas, NV 89193

Possible Financial Inc. © 2025 - NMLS #1697898

All products are subject to eligibility and approval by Possible Financial Inc. dba “Possible Finance” and “Possible” or its banking partner Coastal Community Bank. Eligibility for a product is not guaranteed.

For Loans, Possible Finance has direct lending licenses in CA, HI, ID, NV, UT and WA. Idaho Residents: License #RRL-10073; Louisiana Residents: License #1697898; Nevada License #CDTH11200; Ohio Residents: License #ST.760161.000; Washington License #530-CC/SL-111888. California Residents: Possible Finance is licensed by the Department of Financial Protection and Innovation, pursuant to the California Deferred Deposit Transaction Law, License #10DBO-105848.

Loans in AL, AR, AZ, DE, FL, IA, IN, KS, KY, LA, MI, MO, MS, MT, NC, NE, NH, OH, OK, OR, RI, SC, TN, TX, VA, VT, and WY are made by Coastal Community Bank, and serviced by Possible Finance. Texas Residents: Possible Finance is a licensed Credit Access Business; License #1800061850-160823.

*Funding usually within minutes but may take up to 5 days.

^Loan amounts & structure vary by state.

°Possible uses fee and payday loan usage information from the Consumer Financial Protection Bureau, Center for Responsible Lending, Pew Charitable Trusts, and the Consumer Federation of America to arrive at our Fees Saved Calculation. Savings based on the maximum fees Possible could have charged customers over the typical payday loan term, including late fees, insufficient funds fees, etc. Results will vary.

¨See possiblefinance.com/samplepaymentschedules for rates & terms examples.

ˇReal customer compensated. Results may vary.

˘Possible Loans offer up to 29 days of payment flexibility from original due date.

Possible Card is issued by Coastal Community Bank and serviced by Possible Finance, pursuant to its license with Mastercard International Incorporated. Arizona Residents: Licenses #CA-1033558, #CA-1041621, and #CA-1041622; California Residents: License #10595-99; Hawaii Residents: License #COLAX-1238-0; Illinois Residents: License #17.022449; Louisiana Residents: Registration #446766611; Maine Residents: License #SLM15758; Maryland Residents: License #1697898; Massachusetts Residents: Registration #LS1697898; Nebraska Residents: License #1697898; New Jersey: Registration #19095; North Dakota Residents: License #MB104104; Oregon Residents: License #1697898; Pennsylvania Residents: Registration #95262; South Dakota Residents: License #1697898.MYL; Vermont Residents: License #LSO-1697898; Washington Residents: License #6041888588-001-0001: West Virginia Residents: Registration #2417-3349.

All trademarks and brand names are property of their respective owners. Use of them does not imply any affiliation with or endorsement by them.

If you have questions or concerns, please contact the Support Team at support.possiblefinance.com

Mailing Address: Possible Finance, PO Box 98686, Las Vegas, NV 89193

Possible Financial Inc. © 2025 - NMLS #1697898