At Possible, we believe managing your money shouldn’t come with a manual—or worse, a bunch of fine print.

That’s why we’re launching Possible FAQ, a new video series designed to help you get the most out of using Possible. From tips to boost your chances of approval, to step-by-step walkthroughs of our app, to answers to the questions we hear every day—we’re breaking it all down in easy, accessible videos.

“Our customers ask smart, practical questions every day—and they deserve clear, straightforward answers. With Possible FAQ, we’re turning everyday confusion into confidence. It’s all part of our mission to make financial tools easier to understand and use.”

Scully Wan, Director of Product & Lifecycle Marketing

What to expect from Possible FAQ

We know when customers have questions, they turn to search and social. So that’s where we’re showing up. The FAQ series lives on our website and our YouTube channel so you’ll be able to easily find answers wherever you are. Over 20 more episodes will roll out in the next few months as we launch new features and learn from what you’re searching for.

Watch a few of the first videos:

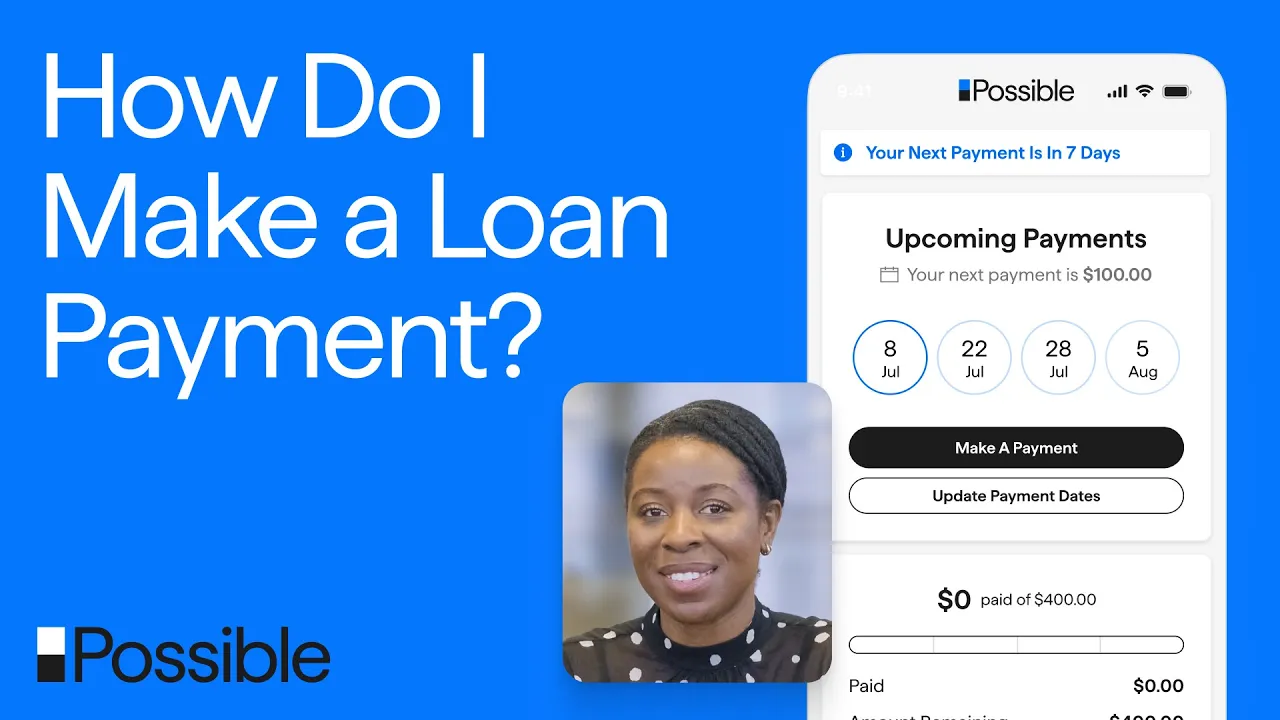

How do I make a payment?

Can I pay off my Possible Loan early?

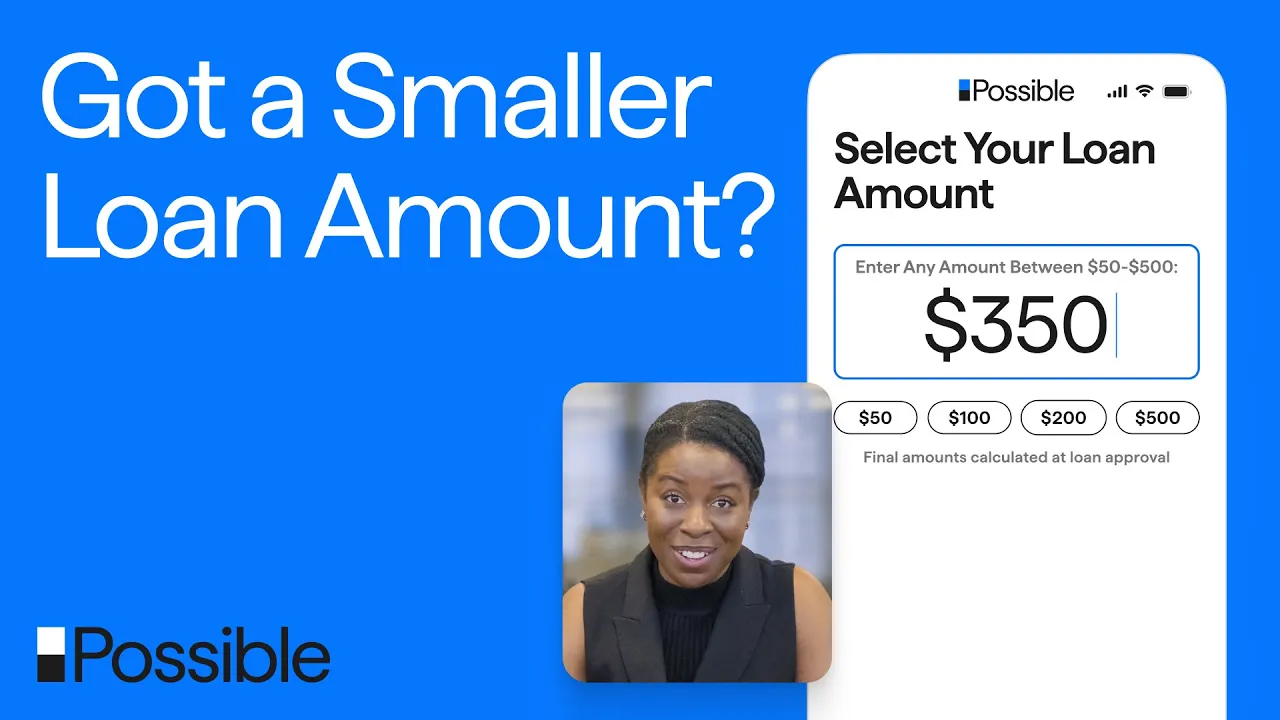

Why did I get approved for less than last time?

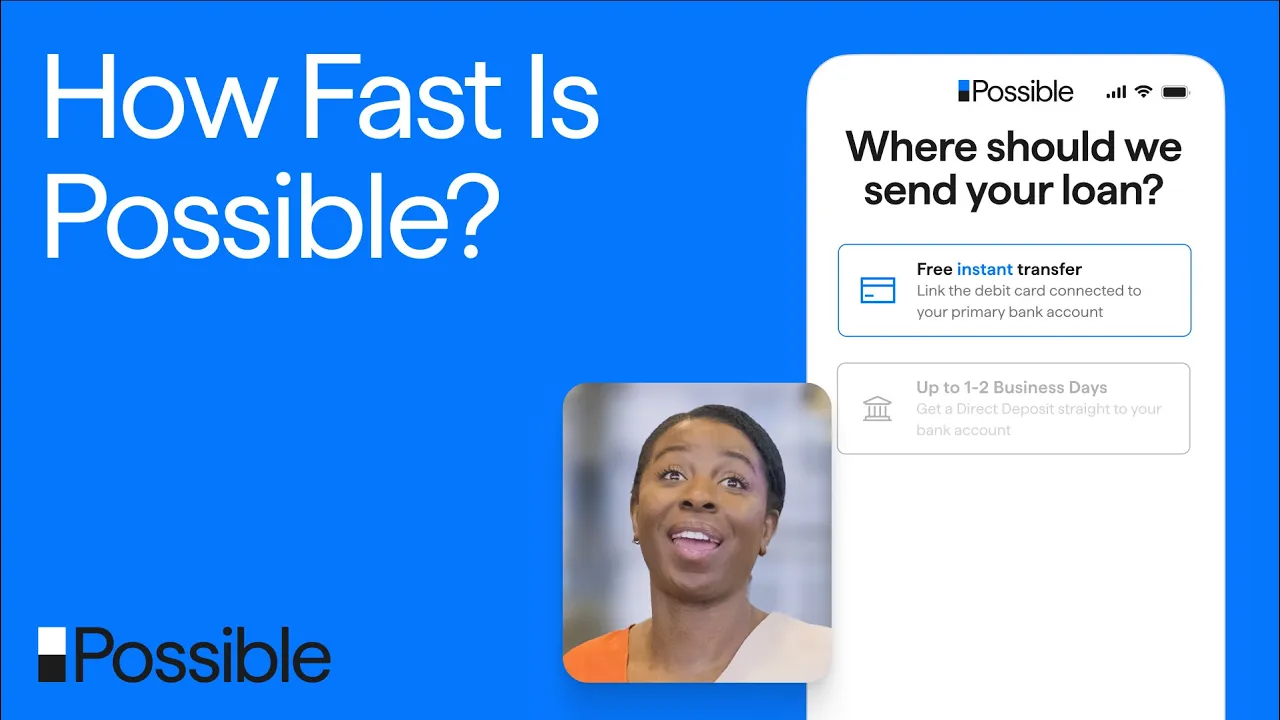

How fast is Possible and when can I get my money?

How do I link my bank account?

Why we’re doing this

Possible FAQ is just one small part of our ongoing commitment to transparency. We’re here to equip you with answers and options—so you can make the financial decisions that fit your life.

👉 Explore the full series: Possible FAQ

🟦 Got questions? We’ve got answers—and more videos coming soon. Check out the full FAQ series to get the most out of using Possible.